Hanging Man Candlestick Pattern

Candlestick patterns have long been a popular tool among traders to predict market movements. These patterns can provide insight into the psychology of market participants and can signal a potential change in trend direction. One such pattern is the hanging man, which is known for its bearish implications. In this article, we will explore the significance of the hanging man pattern, its interpretation, and how traders can use it in their trading strategies.

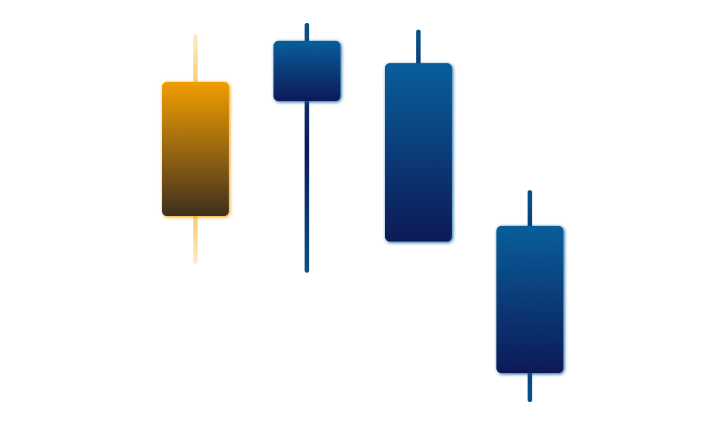

The hanging man is a bearish candlestick pattern that typically occurs at the end of an uptrend. It is characterized by a small real body, a long lower shadow, and little to no upper shadow. The pattern is formed when the market opens near its high but then sells off throughout the day, closing near its low. The long lower shadow indicates that the market attempted to rally but was unable to sustain its gains and eventually closed near its low for the day.

Interpreting the Hanging Man Pattern

The hanging man candlestick pattern is often seen as a sign of weakness in the market, as it indicates that buyers were unable to maintain control and that sellers are gaining momentum. However, it is important to note that the hanging man pattern is not a guaranteed signal of a bearish reversal. It is simply an indication that the market is becoming indecisive and that there may be a potential change in trend direction.

To confirm the bearish signal of the hanging man pattern, traders often look for additional confirmation in the form of bearish candlestick patterns, technical indicators, or other forms of analysis. For example, traders may look for a bearish confirmation candlestick pattern, such as a bearish engulfing pattern, or they may look for a bearish divergence between the price and a technical indicator, such as the relative strength index (RSI).

Using the Hanging Man Pattern in Trading Strategies

Traders can use the hanging man pattern in a variety of ways in their trading strategies. One popular approach is to use the hanging man pattern as a signal to enter a short position or to exit a long position. Traders may also use the hanging man candlestick as a stop-loss level or to set profit targets.

Using the Hanging Man Pattern for Entry and Exit Points

When using the hanging man pattern as a signal to enter a short position or exit a long position, traders typically wait for additional confirmation before taking action. This confirmation may come in the form of a bearish confirmation candlestick pattern, as mentioned earlier, or it may come from other forms of technical analysis, such as trendlines, support, and resistance levels, or moving averages.

For example, a trader may wait for the hanging man pattern to form at a key resistance level or at the top of an uptrend. If the hanging man pattern is confirmed by additional bearish signals, such as a bearish confirmation candlestick pattern or a bearish divergence in the RSI, the trader may enter a short position, expecting the market to continue lower.

Using the Hanging Man Pattern as a Stop-Loss Level

Traders can also use the hanging man pattern as a stop-loss level to protect their trades in case the market does not move in their favor. If a trader is long in a market and the hanging man pattern forms, they may choose to place their stop-loss order just below the low of the hanging man pattern. This ensures that if the market does reverse and move lower, the trader will exit the trade with a limited loss.

Using the Hanging Man Candlestick to Set Profit Targets

Finally, traders may use the hanging man pattern to set profit targets for their trades. When the hanging man pattern forms, traders often look for areas of support or resistance that may act as potential profit targets. For example, a trader may look for a key support level or moving average that the market may test after forming a hanging man pattern. If the market reaches this level, the trader may choose to take profits or exit the trade.

Examples of the Hanging Man Pattern in Trading

To provide a practical example of how the hanging man trading can be used in trading, let’s look at a hypothetical scenario involving a stock that has been in an uptrend for several weeks. The stock has been consistently making higher highs and higher lows but has recently formed a hanging man pattern on the daily chart.

As a trader, we may interpret this hanging man pattern as a potential signal of a bearish reversal, as the long lower shadow indicates that buyers were unable to maintain control, and that sellers may be gaining momentum. To confirm this signal, we may look for additional bearish signals, such as a bearish confirmation candlestick pattern or a bearish divergence in the RSI.

If we are confident in the bearish signal provided by the hanging man pattern and our additional analysis, we may choose to enter a short position on the stock, with a stop-loss order placed just above the high of the hanging man pattern. We may also look for potential profit targets based on areas of support or resistance or other forms of technical analysis.

Final Thoughts

A hanging man pattern is a valuable tool for traders to predict potential trend reversals in the market. While it should not be used in isolation to make trading decisions, it can provide valuable insights into market psychology and momentum. By understanding the characteristics and implications of the hanging man pattern, traders can make informed trading decisions and manage their risk appropriately.