Dark Cloud Cover Candlestick Pattern

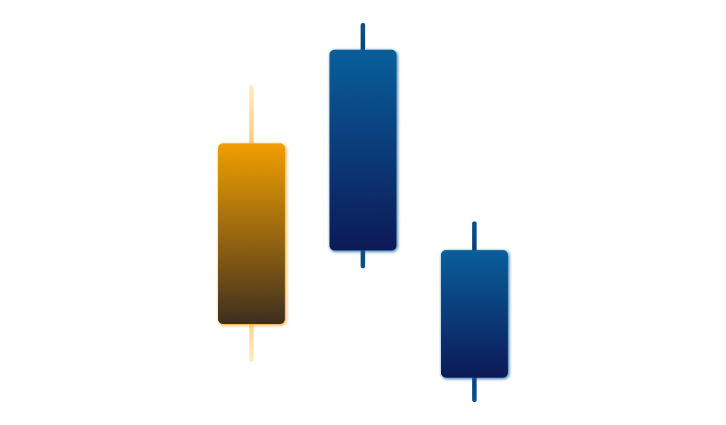

Dark Cloud Cover is a bearish candlestick pattern that signals a potential reversal of an uptrend. It is formed by two candles, with the first candle being a long bullish candle and the second candle being a long bearish candle that opens above the high of the first candle but closes below its midpoint.

The Dark Cloud Cover pattern is an important tool in candlestick trading to identify potential trend reversals and manage their risk accordingly. By identifying and interpreting this pattern, traders can make informed decisions about when to enter or exit trades and when to adjust their trading strategies to better manage risk.

In this article, we will explore the Dark Cloud Cover candlestick in greater detail, examining how it is formed, what it signals, and how traders can use it to make more informed trading decisions.

Formation of the Dark Cloud Cover Pattern

As mentioned earlier, the Dark Cloud Cover candlestick is formed by two candles. The first candle is a long bullish candle that closes near its high, signaling a strong uptrend in the market. The second candle is a long bearish candle that opens above the first candle’s high but closes below its midpoint, indicating a potential reversal of the uptrend.

The second candle of the Dark Cloud Cover candlestick pattern is important because it shows that the bulls were unable to maintain the momentum of the uptrend, and that the bears have begun to take control of the market. The fact that the second candle opens above the high of the first candle suggests that there is still buying pressure in the market, but the fact that it closes below the midpoint of the first candle indicates that selling pressure has started to overwhelm the buying pressure.

Interpreting the Dark Cloud Cover Candlestick

The Dark Cloud Cover candle is a bearish reversal pattern, which means that it signals a potential end to an uptrend and the beginning of a downtrend. Traders should interpret this pattern as a warning that the market may be turning bearish and that it may be time to adjust their trading strategies accordingly.

To confirm the validity of the Dark Cloud Cover, traders should look for additional signals that support the bearish reversal. For example, they may look for the price to break below key support levels or for other technical indicators to confirm the bearish reversal.

Traders should also pay attention to the volume of trading when interpreting the Dark Cloud Cover. If the second candle of the pattern is formed with high trading volume, this can be seen as a stronger signal of a bearish reversal, as it suggests that there is significant selling pressure in the market.

Usage in Trading

The Dark Cloud candlestick can be a valuable tool for traders identifying potential trend reversals and managing their risk accordingly. Traders can use this pattern in a number of ways, depending on their trading style and risk tolerance.

- One way to use the Dark Cloud candlestick pattern is to enter a short position when the pattern is confirmed. Traders may choose to enter a short position when the price breaks below key support levels or when other technical indicators confirm the bearish reversal. This allows traders to profit from the potential downtrend that may follow the pattern.

- Another way to use the Dark Cloud candlestick is to exit long positions when the pattern is formed. Traders who are already in long positions may choose to exit their positions when they see the Dark Cloud candlestick pattern forming in order to lock in profits and avoid potential losses from the bearish reversal.

- Traders can also use the Dark Cloud candlestick as a signal to adjust their trading strategies. For example, they may choose to tighten their stop-loss orders or reduce their position sizes to manage their risk in the face of a potential reversal.

Other considerations when using the Dark Cloud candle in trading include the time frame of the chart being analyzed, the volatility of the market, and the overall trend of the market. Traders should also be aware of any upcoming news or events that may impact the market, as this can affect the validity of the pattern.