Evening Star Candlestick Pattern

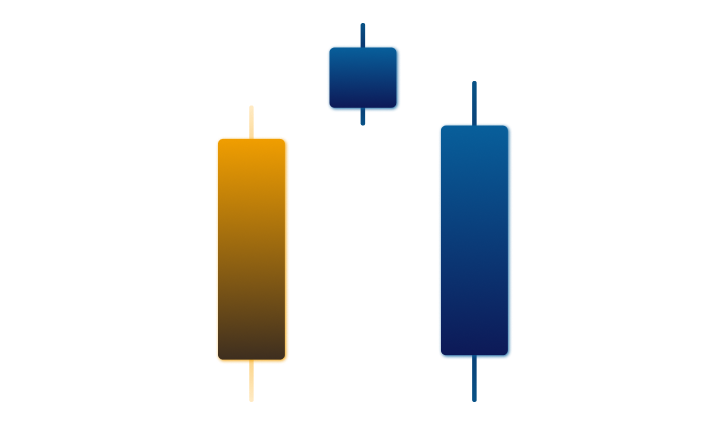

The Evening Star candlestick pattern is a powerful and reliable reversal pattern that can provide traders with significant insight into market trends. This pattern typically occurs at the end of an uptrend and is characterized by a series of three candles. The first candle is a bullish candle, followed by a small candle that can be either bullish or bearish, and the third candle is a bearish candle. This pattern signals a reversal of the uptrend and a possible downward trend, making it an important candle signal for traders to be aware of.

Difference between Evening Star and Morning Star Patterns

The Evening Star candlestick pattern is a variation of the more common Three-Candlestick Reversal Pattern, which includes the Morning Star pattern. The Morning Star pattern is a bullish signal, while the Evening Star is a bearish signal. Both patterns are formed by three consecutive candlesticks, with the middle candlestick being a Doji candlestick or a spinning top. The Doji candlestick indicates indecision among traders and often acts as a signal for a possible trend reversal.

Interpreting the Evening Star Candlestick

The Evening Star candlestick is a reliable indicator of a bearish reversal because it signals a shift in market sentiment. The bullish candle in the first part of the pattern indicates that buyers are in control of the market. However, the small second candle indicates that there is indecision among traders, with neither buyers nor sellers in control. Finally, the bearish candle in the third part of the pattern shows that sellers have taken control of the market, and the trend is likely to continue downward.

How to use the Evening Star Pattern?

The Evening Star is a versatile pattern that can be used in a variety of markets, including Forex, stocks, and commodities. It can be found on all timeframes, from daily to hourly charts, making it suitable for both short-term and long-term traders. Furthermore, the Evening Star pattern can be used in conjunction with other technical analysis tools, such as moving averages and trendlines, to confirm its reliability.

Identification for Trading

To identify the Evening Star candlestick pattern, traders must first look for a bullish candle that is followed by a small Doji or spinning top candle. The small candle indicates indecision among traders, and it is a warning sign that a reversal may be on the horizon. Finally, the third candle must be bearish, indicating that sellers have taken control of the market.

Traders should pay attention to the length of the candles when looking for an Evening Star. The first bullish candle should have a relatively long body, indicating strong buying pressure. The second candle should have a short body, indicating indecision among traders. Finally, the third bearish candle should have a long body, indicating strong selling pressure.

Waiting for confirmation of the Evening Star candlestick before making a trade is essential. Confirmation can be achieved by looking for additional bearish signals, such as a bearish divergence or a break below a significant support level. Additionally, traders can use technical analysis tools, such as moving averages or trendlines, to confirm the reliability of the Evening Star pattern.

When trading the Evening Star pattern, traders should place their stop-loss orders above the high of the bullish candle. This will protect their position in case the market does not reverse as expected. Traders can take profits by setting a target price based on the distance between the high of the bullish candle and the low of the bearish candle.

Advantages of Evening Star Candlestick Pattern

One of the advantages of the Evening Star pattern is that it provides traders with a clear signal to enter the market. This makes it easier to plan a trade and manage risk. Traders can use the Evening Star pattern to enter short positions when the trend is likely to reverse, reducing the risk of being caught on the wrong side of the market.

Another advantage of the Evening Star pattern is that it is a highly reliable signal. The pattern is easy to identify and can be used in conjunction with other technical analysis tools to increase its accuracy. This makes it a valuable tool for traders who want to make informed trading decisions.

Final Thoughts

However, the Evening Star pattern is not infallible and should not be relied on as the sole indicator of market trends. Traders should always use multiple indicators and tools to confirm market trends and make trading decisions. Additionally, traders should always use proper risk management techniques, such as setting stop-loss orders and taking profits at predetermined levels.