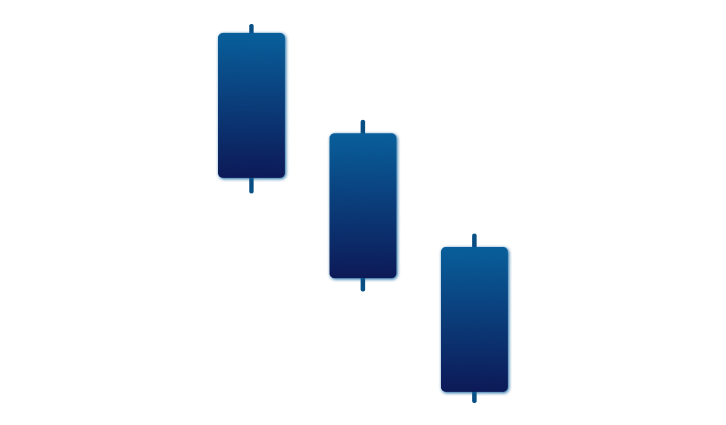

Three Black Crows Candlestick Pattern

Three black crows is a term used in technical analysis to describe a pattern of consecutive bearish candlesticks on a price chart. This pattern is considered a reliable indicator of a potential reversal of an uptrend or bullish market sentiment. This pattern is also known as “3 black crows” and is the opposite of three white soldiers pattern. In this article, we will delve deeper into the mechanics of three black crows as a reliable candle pattern, explore how they can be identified on a price chart, and examine their significance for traders and investors.

Definition of Three Black Crows

Three black crows is a bearish reversal pattern consisting of three consecutive long-bodied candlesticks, with each opening higher than the previous day’s close and closing lower than the previous day’s close. The candles must have a long real body and a small or non-existent upper shadow, indicating that selling pressure is strong and persistent. Typically, this pattern is formed after a prolonged uptrend, suggesting that buyers have lost control of the market and sellers are taking over.

Identifying Three Black Crows Pattern

Identifying 3 black crows on a price chart is relatively easy. Traders and investors can look for the following characteristics:

- Three consecutive long-bodied candlesticks: Each candlestick must have a long real body, indicating that there is strong selling pressure in the market. The length of the body is an indication of the strength of the bearish sentiment.

- Opening higher than the previous day’s close: The opening price of each candlestick should be higher than the previous day’s closing price. This indicates that the market is opening higher, but sellers are driving the price down.

- Closing lower than the previous day’s close: The closing price of each candlestick should be lower than the previous day’s closing price. This indicates that sellers are in control of the market and are driving the price lower.

- Small or non-existent upper shadow: The candlesticks should have a small or non-existent upper shadow, indicating that selling pressure is persistent and strong.

Significance in Trading

The three black crows candlestick pattern is a reliable indicator of a potential reversal of an uptrend or bullish market sentiment. When this pattern appears on a price chart, it suggests that sellers are in control of the market and that a bearish trend may be emerging. This pattern can provide traders and investors with an opportunity to take profits on long positions or to enter into short positions.

Traders and investors should be cautious when interpreting the three black crows. While it is a reliable indicator of a potential reversal, it is not a guarantee that the market will reverse.

Limitations of Three Black Crows

As with any technical analysis tool, the three black crows candlestick pattern has limitations. One of the main limitations is that it is a lagging indicator, meaning that it confirms a trend that has already started. Traders and investors may miss out on potential gains if they wait for this pattern to appear before taking a position in the market.

Another limitation of the three black crows candlestick pattern is that it can be easily mistaken for other bearish patterns, such as the bearish harami or the bearish engulfing pattern. Traders and investors must be careful to identify the pattern correctly to avoid making incorrect trading decisions.