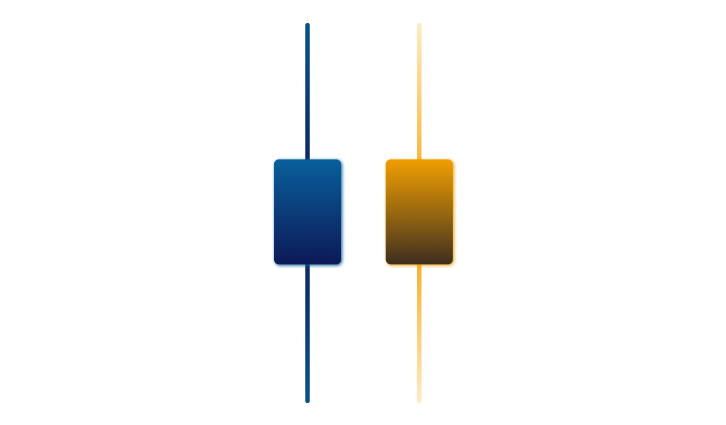

Spinning Top Candlestick Pattern

The spinning top candlestick is one of the most commonly used technical analysis tools for interpreting market trends. This pattern is characterized by a small body with a long upper and lower shadow, indicating indecision in the market.

A spinning top candlestick is a type of candlestick pattern that occurs when the opening and closing price of an asset is almost the same, resulting in a small body, while the shadows or wicks above and below the body are long. The pattern shows that neither the bulls nor the bears have taken control of the market, and the price of the asset is likely to move in either direction.

In a spinning top candlestick pattern, the length of the shadows is typically two to three times longer than the length of the body. The color of the body can be either bullish spinning top or bearish spinning top, and the pattern can occur in any market or time frame.

Formation of a Spinning Top candlestick pattern

The spinning top candlestick forms when there is an equilibrium in the market between buyers and sellers. It typically occurs after a strong price move in either direction, indicating a pause or hesitation in the market.

To form a spinning top candlestick pattern, the opening and closing price of the asset must be close to each other. The smaller the difference between the opening and closing price, the smaller the body of the candlestick will be. The shadows or wicks, on the other hand, represent the high and low prices of the asset during the trading session.

How to Interpret a Spinning Top candlestick?

The spinning top candle is a neutral pattern that can be interpreted in different ways depending on the context in which it appears. It can be used to indicate a potential reversal in the market or a continuation of the current trend.

When the spinning top candlestick pattern appears after a strong uptrend, it could indicate a potential reversal in the market. This is because the pattern shows that the buyers are losing their momentum, and the sellers are gaining strength, which could result in a price reversal.

On the other hand, when the spinning top candle appears after a strong downtrend, it could indicate a potential reversal in the opposite direction. This is because the pattern shows that the sellers are losing their momentum, and the buyers are gaining strength, which could result in a price reversal.

However, the spinning top candlestick pattern can also be interpreted as a continuation pattern, especially when it appears during a consolidation phase. In this case, the pattern shows that there is indecision in the market, but the current trend is likely to continue.

Spinning Top candle in Trading

The spinning top trading can be used in various trading strategies, including trend following, reversal, and breakout strategies. The key is to use the pattern in conjunction with other technical analysis tools and indicators to confirm the market trend and avoid false signals.

Trend following strategy

In a trend following strategy, traders use the spinning top candlestick pattern to confirm a potential trend reversal or continuation. For example, suppose the spinning top candlestick pattern appears after a strong uptrend. In that case, traders may use it as a signal to close their long positions and consider shorting the asset if other indicators confirm a potential reversal.

Reversal strategy

In a reversal strategy, traders use the spinning top candle as a primary signal to enter a trade in the opposite direction of the current trend. For example, suppose the spinning top candlestick pattern appears after a strong uptrend. In that case, traders may use it as a signal to enter a short position if other indicators confirm a potential reversal.

Breakout strategy

In a breakout strategy, traders use the spinning top candle to identify potential breakouts from a consolidation phase. For example, if the spinning top candlestick pattern appears within a narrow trading range, traders may use it as a signal to enter a long or short position if the price breaks out of the range in the direction indicated by the pattern.