In the world of trading, candlestick patterns are key for showing price action and spotting trends. The wicks or shadows in these charts are very important for analysis. They show the highest and lowest prices in a time frame, going beyond the candlestick’s body.

By looking at these wicks, traders can make better choices. They can improve their trading plans and understand market changes better.

Key Takeaways

- Candlestick wicks show the high and low prices within a period.

- Wicks are essential for technical analysis and identifying market trends.

- Analyzing candlestick patterns can help develop effective trading strategies.

- Understanding wicks helps in interpreting market sentiment and potential reversals.

- Attention to wicks can lead to more informed and strategic trading decisions.

Introduction to Candlestick Wicks

Candlestick wicks are key in technical analysis for the stock market. They show the highs and lows of a trading period. This helps traders see how much the price moved.

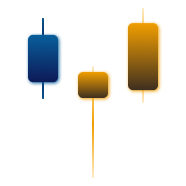

What Are Candlestick Wicks?

Candlestick wicks, or shadows, show the highest and lowest prices during a trading period. The upper wick shows the highest price. The lower wick shows the lowest price. This helps traders understand price movement and volatility.

The Importance of Candlestick Wicks in Trading

Candlestick wicks are vital for traders to understand the stock market. They show if prices were accepted or rejected, giving clues about future trends. By analyzing wicks, traders can make better decisions on when to buy or sell.

Using wick information helps traders predict price movements. This can be for a bullish or bearish trend. It makes trading more strategic and effective.

Different Types of Candlestick Wicks

Knowing about candlestick wicks is key for traders. Each type shows different things about the market. Wicks, or shadows, can be long or short and tell us about forex trading and other markets.

- Long Wicks: A long wick means the market is very volatile. If it’s an upper wick, it could mean a trend is changing. If it’s a lower wick, it shows strong market strength at that price.

- Short Wicks: Short wicks mean the market is stable with little change. They often show there’s no strong feeling in the market.

- Upper Wicks vs. Lower Wicks: Upper wicks happen when the day’s high price is not reached at close. This means sellers are strong at that level. Lower wicks show buying pressure at the day’s low.

- Single Wick Candles: These are seen in doji or pin bar patterns. They suggest indecision or a possible change in trend. The single wick shows a big fight between buyers and sellers.

- Candles with Both Upper and Lower Wicks: These candles mean the market is unsure and might be consolidating. They help traders see where the market might stop or turn, which is important for forex trading.

By looking at these chart patterns and the wicks in candlesticks, traders can understand market trends better. They can spot signs of continuing trends, changes, or consolidation. This helps them make smart trading moves.

Using Candlestick Wicks in Technical Analysis

Technical analysis uses candlestick wicks to understand market trends. These wicks help spot price changes. They are key to many candlestick patterns. When used with tools like moving averages and RSI, they help traders make better choices.

Interpreting Wick Patterns

Looking at wick patterns tells us a lot. For example, the “hammer” pattern at a downtrend’s end might mean a change in trend. The “shooting star” pattern at an uptrend’s peak could warn of a drop. Knowing these patterns helps traders make smart moves.

Common Technical Indicators

Using wick analysis with technical indicators makes trading signals stronger. Important indicators are:

- Moving Averages: These smooth out price data to show trends.

- Relative Strength Index (RSI): This measures how fast and how much prices change.

- Bollinger Bands: These set price limits using standard deviations.

Combining wick patterns with these indicators strengthens trading signals. It also gives clues about where prices might go.

| Technical Indicator | Primary Function |

|---|---|

| Moving Averages | Trend Identification |

| Relative Strength Index (RSI) | Momentum Measurement |

| Bollinger Bands | Price Boundary Assessment |

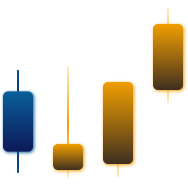

Candlestick Patterns Featuring Wick Analysis

Wicks in candlestick patterns are key for technical analysis. They show important info about price action and market feelings. This helps traders make smart choices. We’ll explore several patterns where wicks are very important.

Dojis are a well-known pattern in technical analysis. They show the market is unsure, with opening and closing prices close together. The wicks show the price range during the day. This helps traders see if the market might change direction.

Spinning tops are also crucial. They have small bodies with long wicks on both sides, showing a fight between buyers and sellers. Even though the body is small, the wicks tell us about price changes during the day. Spinning tops might mean a change in market feelings, so traders should look for more signs before acting.

Inverted hammers are another key pattern. They appear at the end of a falling trend and have a small body with a long upper wick. This wick shows sellers tried to drop prices but buyers pushed back. Seeing an inverted hammer can signal a possible upturn in prices.

The table below summarizes these patterns and their meanings, making it easy for traders to remember:

| Candlestick Pattern | Description | Significance |

|---|---|---|

| Doji | Small body, long wicks | Market indecision, potential reversal |

| Spinning Top | Small body, wicks on both sides | Indecision, possible trend change |

| Inverted Hammer | Small body, long upper wick | Possible bullish reversal |

Knowing and understanding these patterns helps traders read price action better. By using wick analysis in their analysis, traders can better follow market trends and improve their trading plans.

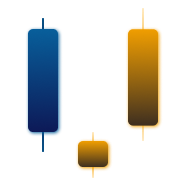

How Candlestick Wicks Reflect Market Sentiment

Candlestick wicks are key to understanding shifts in market sentiment. They show the psychological and strategic forces behind price changes. By looking at their length and position, traders can see what’s driving the market.

Buyer and Seller Equilibrium

Candlestick wicks tell us about the balance between buyers and sellers. Long upper wicks mean sellers are strong, pushing prices down. Long lower wicks show buyers are strong, pushing prices up.

Identifying Market Reversals

Wick patterns, along with market volume and events, help spot market reversals. A long upper wick before a downward trend can signal a change. Looking at wick lengths and positions helps predict market shifts.

| Wick Type | Market Sentiment Indication | Potential Price Action |

|---|---|---|

| Long Upper Wick | Selling Pressure | Possible Downward Reversal |

| Long Lower Wick | Buying Pressure | Possible Upward Reversal |

| Short Wicks | Indecision | Consolidation |

Using these insights, traders can make smarter choices in the stock market. Candlestick wicks give a detailed look at market sentiment and price trends.

Applying Candlestick Wick Insights to Effective Trading Strategies

Using candlestick wick analysis can make your trading decisions better in the forex market. It helps you understand market sentiment by looking at wick length and position. This can improve your technical analysis.

Traders can set stop-losses and take-profits by watching candlestick wicks. A long upper wick might show sellers pushed prices down after a quick rise. This could mean a resistance level. On the other hand, a long lower wick suggests strong buying, pointing to a support level for setting a stop-loss.

- Combining wick patterns with trend lines

- Utilizing support and resistance levels

- Integrating technical indicators for a holistic view

Linking wick patterns with trend lines and support/resistance levels makes trading signals stronger. It helps in building solid forex trading methods. Adding wick analysis with technical indicators like Moving Averages or Relative Strength Index (RSI) makes your strategies more precise.

| Wick Pattern | Market Sentiment | Trading Strategy |

|---|---|---|

| Long Upper Wick | Bearish Rejection | Consider Short Positions |

| Long Lower Wick | Bullish Rejection | Consider Long Positions |

| Small Wicks | Market Indecision | Avoid New Trades |

Let’s look at a trade example with EUR/USD. If a long upper wick appeared at a key resistance level, and the RSI showed it was overbought, it was a sign to short. This mix of signals could lead to a profitable trade. Using wick insights like this can be key to trading success.

Conclusion

Our deep dive into candlestick wick analysis shows its key role for traders wanting to stand out. Knowing the types of candlestick wicks and their role in analysis can boost trading strategies. It helps traders understand market feelings and make better choices.

We showed how candlestick patterns with wicks can point to big market moves. These can show balance between buyers and sellers or possible changes in direction. This knowledge helps traders deal with the complex financial markets better.

Adding candlestick wick analysis to your tools means always learning and adapting. Markets are always changing. This constant learning helps traders improve their strategies.

Using candlestick wicks and technical analysis together leads to better trading success. By keeping up with market trends and using these tools, you can make smarter trading choices. This leads to a deeper understanding of the market, helping you make more strategic moves.

FAQ

What are candlestick wicks in trading?

Candlestick wicks, also known as shadows, are lines on a chart that show the price range over time. They reveal the high and low prices reached. This information helps understand market dynamics and trader feelings.

Why are candlestick wicks important in trading strategies?

Candlestick wicks are key because they show if prices are accepted or rejected. This helps traders guess where prices might go next. It also helps in making smart decisions on when to buy or sell.

How do candlestick patterns influence technical analysis?

Candlestick patterns, with their wick formations, are vital in technical analysis. Patterns like ‘hammer’, ‘shooting star’, ‘dojis’, and ‘spinning tops’ hint at market trends and price changes. This helps traders predict market moves.

What are some common types of candlestick wicks?

Common candlestick wicks include long, short, upper, and lower wicks. Each type signals different market conditions, like strong buying or selling, trend changes, or support and resistance levels.

How can I use candlestick wicks in my forex trading strategies?

In forex trading, candlestick wicks help spot support and resistance levels, trend reversals, and confirm trading signals with other indicators. They make navigating the forex market easier.

What is the significance of long upper wicks in market analysis?

Long upper wicks show selling pressure, where prices were pushed up but then fell back. This often means a bearish trend might start, warning traders of a possible price drop.

How do candlestick wicks reflect market sentiment?

Candlestick wicks show how buyers and sellers react at certain prices. Long wicks suggest indecision or a possible reversal, helping traders understand the balance between buying and selling.

Can candlestick wicks be used with other technical indicators?

Yes, combining candlestick wicks with indicators like moving averages, RSI, and Bollinger Bands strengthens trading signals. This improves the accuracy of market forecasts.

How can I identify market reversals using candlestick wick analysis?

Market reversals are spotted with specific candlestick patterns like ‘hammer’ or ‘shooting star’. These wicks show a shift in market sentiment, hinting at a trend change.

What are the practical applications of candlestick wick insights in trading strategies?

Candlestick wick insights help set stop-loss and take-profit levels, find the best entry and exit points, and blend with trend lines and support/resistance levels. This improves trading strategies, making them more effective and reducing risks.