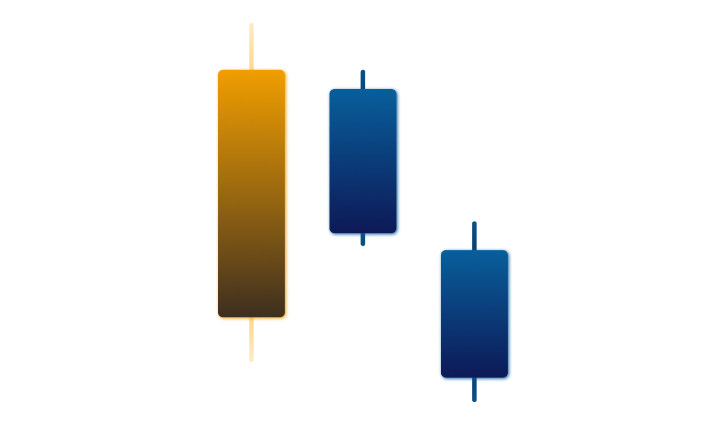

Three Inside Down Candlestick Pattern

Candlestick patterns are an important tool used by traders to analyze and predict price movements in financial markets. One such pattern is the three inside down candlestick pattern, which is a bearish reversal pattern that can signal a potential change in trend. In this article, we will explore the three inside down candlestick pattern in detail, including how to identify it, its characteristics, and its significance in trading.

What is the Three Inside Down Candlestick Pattern?

The three inside down candlestick pattern is a bearish reversal pattern that consists of three candles. It is also known as “3 inside down.” The pattern is formed when a long green candle is followed by two smaller red candles, with the second red candle closing below the midpoint of the first green candle. This pattern indicates that the bulls have lost control, and that the bears are starting to take over.

The first candle in the pattern is a long green candle, which represents a bullish move. This candle shows that the bulls are in control and that the price is rising. However, the second and third candles in the pattern are smaller red candles, which indicates that the bears are starting to take control. The second red candle opens higher than the close of the previous green candle but then closes lower than the opening of the first red candle. The third red candle opens lower than the close of the second red candle and closes below the midpoint of the first green candle, completing the pattern.

Characteristics of Three Inside Down

The three inside down candlestick pattern has several characteristics that traders should be aware of when identifying the pattern.

- First, the pattern is a bearish reversal pattern, which means that it signals a potential change in trend. This is because the pattern shows that the bulls are losing control, and that the bears are starting to take over.

- Second, the pattern consists of three candles, which is why it is called the three inside down candlestick pattern. The first candle in the pattern is a long green candle, followed by two smaller red candles. The second red candle opens higher than the close of the previous green candle, but then closes lower than the open of the first red candle. The third red candle opens lower than the close of the second red candle and closes below the midpoint of the first green candle, completing the pattern.

- Third, the pattern is a strong bearish signal when it occurs after an uptrend. This is because the pattern indicates that the bulls have lost control, and that the bears are starting to take over. As a result, traders may consider selling their positions or opening new short positions.

- Finally, the pattern has a high degree of reliability when it occurs with high trading volume. This is because high trading volume indicates that there is a significant amount of interest in the stock, and that there may be a significant shift in sentiment.

Significance in Trading

The three inside down pattern is a significant pattern in trading because it signals a potential change in trend. When the pattern occurs after an uptrend, it can be a strong bearish signal that indicates that the bulls have lost control, and that the bears are starting to take over.

Traders who identify the three inside down patterns may consider selling their positions or opening new short positions. However, no trading signal is 100% accurate, and traders should always use proper risk management techniques.

In addition to using the three inside down candlestick as a trading signal, traders may also use other technical indicators to confirm the pattern. For example, traders may look for bearish crossovers on moving averages or bearish divergences on the relative strength index (RSI) to confirm the pattern.

Moreover, the timeframe when trading the three inside down candlestick patterns is a very essential factor to consider. The pattern may be more significant on longer timeframes, such as daily or weekly charts, as they show a broader view of the market. However, traders should also consider shorter timeframes, such as hourly or 15-minute charts, as they may provide more precise entry and exit points.